If out of all the investment instruments currently available on the market you choose bonds, you are probably not there to risk your capital. And you are not alone. A lot of people like the idea of receiving stable low-risk passive income. Today we will be digging into the concept of bonds and helping you develop a strategy to invest in bonds effectively.

What are bonds and how do they work

Bond is an instrument of indebtedness of the bond issuer to the holders. It can be said that by buying a bond you are lending your money to the issuer: after a certain (predetermined) period of time, you will get back both the principle and the interest alike. The difference between a loan and a bond is the time you receive income. When buying the bond, you will get the majority of funds back only at the end of the period.

Bonds can be issued by national and municipal governments, as well as private companies

As stated above, bonds are oftentimes compared to a loan and for a good reason. In both cases the lender is providing the recipient with money, receiving an interest as remuneration over time. The good thing about bonds is that they guarantee relatively higher returns. Bonds’ maturity can be between 3 months and 30 years. Only after this period, the investor will receive his entire payment. Until that, only the annual interest payment (also called the coupon) will be provided. The interest can change during the lifetime of a fond, sometimes upwards.

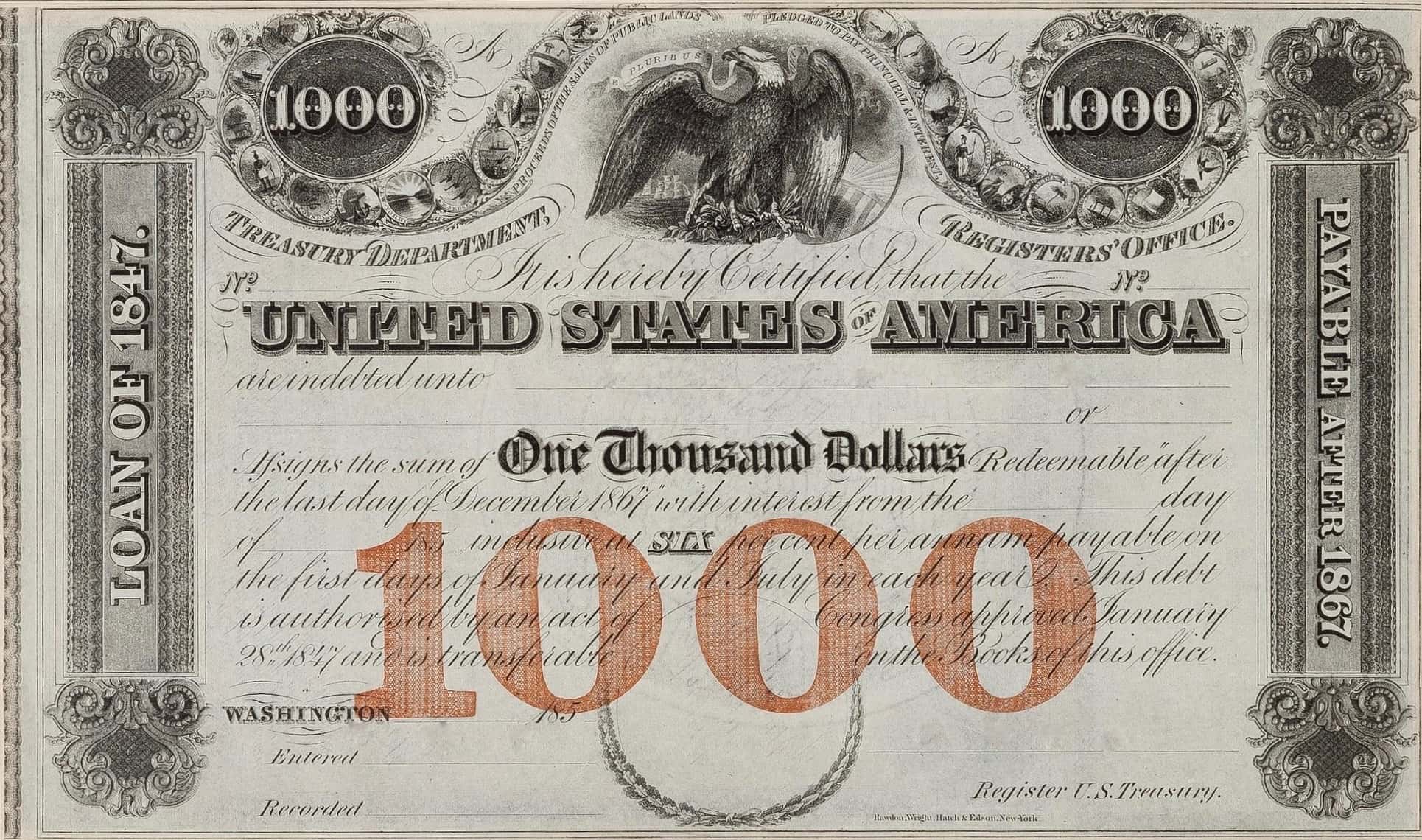

An example of U.S. Government Loan for the Mexican-American War

Bonds can be obtained on the stock market through the mediation of a professional broker. Certain types of bonds can be obtained by private investors in the bank office, though their interest rate is noticeably lower. They, therefore, do not deserve the attention of an earnest investor.

What kind of profit should you be expecting when purchasing bonds?

The average annual interest rate for USD-denominated bonds is set at 6–12%.

Bonds-related risks

Risks, associated with a bond purchase, can be compared to that of a bank loan. Both instruments belong in the low-risk category. In most cases, the yield on bonds can be pre-calculated, and it is something you will receive, guaranteed. As always in the world of finance, low risks have a downside to them — abnormally high returns are impossible. Nonetheless, as with any other instrument, binds are not completely risk-free.

Your number one concern when picking a company to buy bonds from is bankruptcy

When going bankrupt, the issuer is no longer capable of covering his liabilities. We are not saying it happens too often. Yet, it still happens, especially when the issuer is making a lot of the wrong decisions. Inflation is another risk you will come across, as it can eat up a substantial portion of your potential profit. Sometimes it can even exceed annual interest rate. However, when the national economy is doing relatively good, there is no risk of receiving negative income on a bond. Moreover, there is an entire class of inflation-indexed bonds, that reliably protect the investor from income depreciation.

Risks, associated with bonds, should not be completely neglected but for most investors, the advantages usually outweigh the disadvantages.

Guaranteed profitability, high liquidity and easy purchase process all make bonds lucrative.

How to find bonds with the highest profit?

It totally depends on the issuer how profitable the bond will be. The more money he needs, the high the annual interest rate will be. But beware: risks will also climb higher, as the company that needs money that bad doesn’t deserve your confidence.

Key rate, set by the national central bank, can also influence the profitability of the bond. The general rule here is the following: when the key rate is about to go up it is wise to invest in bonds with a maturity of between 1 and 2 years. When the key rate is expected to go down, long-term bonds take the lead. Short-term bonds are more profitable when the key rate is higher due to the fact that they can be redeemed faster. By buying a long-term bond you are waiting out the bad moment to receive more in the future. This is, of course, an advanced level strategy but still, you can keep it in mind to use sometime.

Bonds’ profitability will depend on the exchange rate, as well. When the national economy is doing good, profitability will grow, following the exchange rate of the denominated currency. However, at times of a major financial crisis, this rule won’t work. Exchange rate movements and bonds’ profitability can be inversely correlated. When the recession is ripe, U.S. bonds are a good choice: as history shows, American companies have higher chances of pulling it through.

Which bonds to trust

As already said, the reliability of the bond itself will depend on the issuer and his financial position. The lower the risk of bankruptcy, the more reliable it will be. Unfortunately, there is no reliable way to estimate how close the company is getting to becoming bankrupt. You are the one who is responsible for carrying out the analysis of the issuer. Financial reports can be found right on the official website of the company or somewhere else in the net.

Summing up

Bonds are one of the safest ways of funds allocation. Out of all low-risk instruments, it is the most profitable one, as well. If you are not yet ready to take the risk take a closer look at this instrument. Whatever you choose, don’t invest your entire capital into one source of income. And remember: invest only that money you can afford to invest 😉