Tracking your income is as important as expenses. This is the only way to grasp your entire financial landscape. We’ll tell you, why else you should mind your income, and how Moneon helps you do this.

Income sources

Salary is the source of income for most of us. But when you think about it, it turns out that income sources can extend to a much wider range. For example:

- Gifts

- Personal business

- Sales on eBay and other platforms

- Cashback

- Profit from bank deposits and investing activity

- Scholarships, bonuses etc.

Just like with expenses, it’s important to take into account everything, whether it is winning the HQ game or getting your monthly bonus. As early as at this stage we'll emphasize one of the main advantages of income accounting — you start seeing endless possibilities around you to increase your gains. You may monetize your hobby or may decide to sell a lot of things you don’t use anymore.

What gets measured gets improved

Robin. S. Sharma

Balance in everything

Balance is the difference between all your income and expenses. Similarly to business, this is your profit. This is the «free» money to spend on repaying the debts, making savings, or investing — it’s up to you to decide. I think you would agree that calculating your own profit without accounting your income is a hard-to-handle task.

Of course, it’s worth attempting to increase your balance. For this, it’s not necessary to augment your income sources (though this way is also fine). Another way is to reduce your expenses, for example, through use of budgets. Income underlies any savvy budget. Without a clear understanding of how much money you get, it's very difficult to assess, how much you can spend.

The balance value can encourage you. The major purchase might stronger affect your daily expenses reducing allowable budget or requires that you would save money longer. In this case, you should look around searching for additional income. You may offer your skills at the freelance market or have a vacant room to lease at Airbnb.

When a number of income sources grows, accounting starts taking more time. And this is where Moneon can help you.

Accounting income in Moneon

Adding income

To add income, all you have to do is to click Expenses when adding a transaction. It will change for Income. Then proceed as usual: enter the amount, add categories, tags, and comments, if you want to.

Multi-currency also applies to income. The sequence is similar to that for expenses. Enter the income amount, click currency symbol on the right, choose the one you need from the list, and that’s it! The application automatically converts income in the main currency of the wallet.

After the first income is added, Summary and Transactions tabs will get the respective sections.

The Balance item also appears with them on the main screen. If it is not displayed correctly, you can change it any time. Click Properties in the Menu. In the opened section you will see “Edit balance” button.

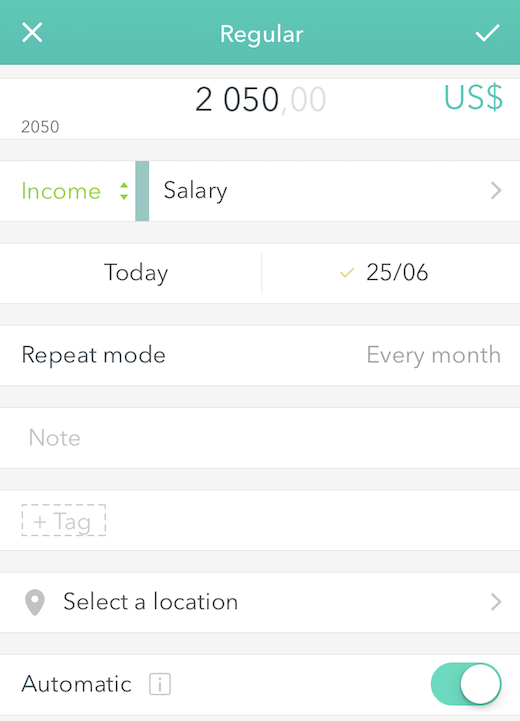

Regular income

You can easily trust us with accounting your regular income, for example, salaries or study allowances. When creating a regular transaction, click Expenses, set the amount and frequency.

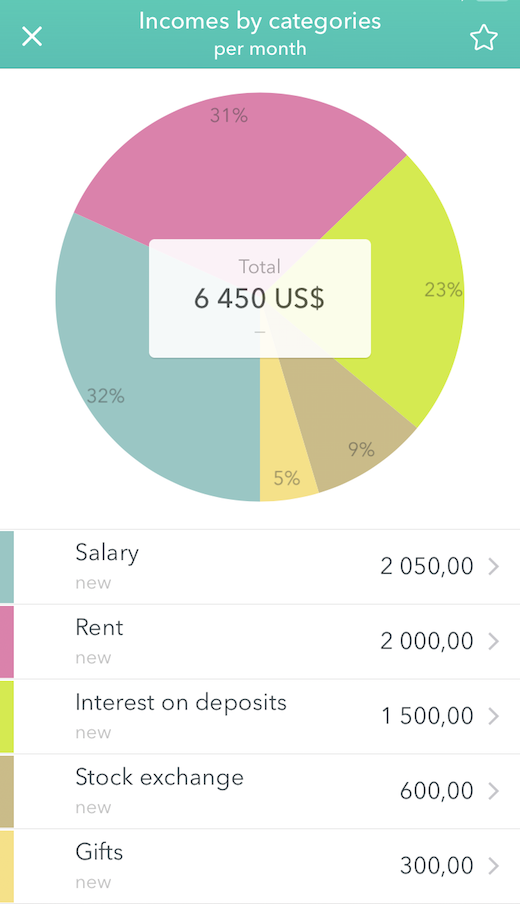

Income report

You can create income reports in the Reports section. It shows you composition and frequency of your income.

Now income accounting is available in the standard version of the application. This will allow you to efficiently manage your finance now and in future. More income and less excessive expenses — you can handle this 💪